Introduction:

From 2019 Pre-Covid till 2023, we have seen several changes in the employment law space from the Government’s focus on an older workforce; the presence of more managers and executives and efforts on protecting employee rights for unfair or wrongful termination.

You may have been missed these changes while looking after your need to increase headcounts or train staff for new roles.

Are you holding onto an outdated or unreliable employment agreement or employment handbook that needs to be refreshed or at least reviewed?

Ask yourself:

- Do you have older employees above 55 years of age or nearing 62 years old?

- Do you know what are the “Part IV Provisions(i)” or what is known as the “Part IV Employees”?

- Are you aware that there are Core Provisions(ii) that every employee in Singapore is entitled to?

- Did you know that Budget 2023 made distinct changes to look after Singaporeans and to cater to different employees e.g. platform workers and seniors?

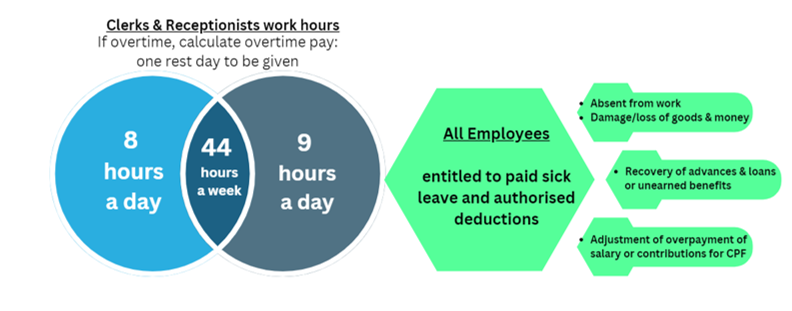

(i) Part IV Provisions of the Employment Act are sections in the Employment Act which protect certain class of employees by providing rest days, hours of work and other conditions of services. Part IV Provisions applies to a workman (doing manual labour and earning not more than $4,500) or to non-workman (clerks and administrators) who earns not more than $2,600 but excludes managers and executives. A manager or executive is one whose duties and capacity may include making decisions on managing and running the business, formulating strategies or dealing with issues on recruitment, discipline, termination and performance assessment and reward.

(ii) All employees working in Singapore are entitled to minimum days of annual leave, paid public holidays and sick leave, timely payment of salary and statutory protection against wrongful dismissal. Seafarers, domestic workers and public officers will not be covered under the Employment Act as they will be covered by other acts.

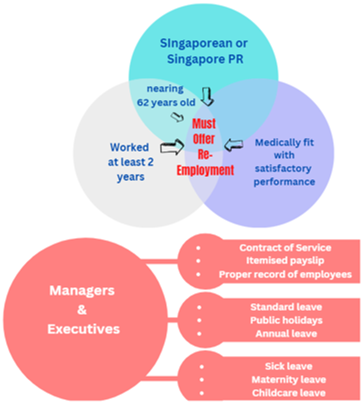

Change No. 1 – Re-employment of Senior Employees in Your Workforce

According to the Retirement and Re-employment Act, the minimum retirement age is 63 years. Employers must be offered re-employment based on eligibility criteria who turn 63 years old up to the age of 68. Retirement age will progressive go up to 65 and expected to increase over time.

The Act applies to Singapore Citizens and Singapore PRs who have performed at least satisfactorily in their work and medically fit. The contract offered should at least be 1 year. If the employer is unable to offer a position, then the employer must either transfer to another employer or offer a one-time employment assistance payment to the employee of 3.5 of employee’s monthly salary with a minimum of at least $4,500 and maximum payout of $14,750.00.

Change No. 2 – Core Provisions to Extend to ALL Managers and Executives (“M&E”)

Before 1 April 2019, M&Es who earned $4,500 or more were not covered by the Core Provisions. Now, all M&Es are covered under the Employment Act. Seafarers and domestic workers and public servants are not covered because they are covered by other Acts and regulations.

Why the Change to the Employment Act?

Big number of managers and executive entering our workforce and more disputes between employees and employers requiring focused attention to look after the interests of groups.

Change No. 3 – Managers & Employees Would Not be Covered under the IV Provisions

This means that for hours of work, rest days and overtime payment, these clauses do not apply to M&Es and it would be subject to the employment agreement entered into between the employer and employee.

While the Act requires employers to allow IV Employees to carry forward unused annual leave entitlements for another 12 months, there is no such requirements for M&Es.

If an M&E works on a public holiday, you do not have to compensate the employee with money but to offer time-offs. Part IV employees must be compensated.

Change No. 4 – Non-Workman have More Cover For Overtime Pay

Receptionists and clerks who earn up to $2,600 (we will term them as non-workmen) will be protected by Part IV provisions meaning that if they work overtime, they should be compensated.

We foresee some challenges because if employers wanted to beat the system they could increase the non-workmen’s salary by $20 and push it over $2,600 to ensure that IV provisions would not apply.

Employers will need to identify if they have non-workmen in their team and consider the best strategy forward.

Change No. 5 – Wrongful Dismissal and Employment Claims Tribunal

Wrongful dismissal will now be heard by the Employment Claims Tribunal instead of MOM which was the case before 1 April 2019.

The procedure is for aggrieved parties to attend mediation at the Tripartite Alliance for Dispute Management Centre (TADM) so that issues related to both salary and wrongful dismissal can be addressed in the same venue.

Change No. 6 – Shorter timelines for M&Es to File Wrongful Dismissal Claims

M&Es will no longer have to wait 1 year to file for wrongful dismissal claims. If they have served 6 months with the employer and feel that they have been aggrieved, they are entitled to file a complaint.

All other employees (strangely though) do not have any minimum service period to serve the employer.

Change No. 7 – Accepting MCs from all Registered Doctors

Employers will need to educate their HR managers that Employers are to accept all MCs issued by doctors registered under the Medical Registration Act and dentist registered under the Dental Registration Act for paid sick leave. It will no longer be the case (as it was before 1 April 2019) that only medical certificates issued by Government doctors or company-approved doctors and dentists would be approved. Our observations, many employment handbooks and employment agreements continue to insist on government hospital MCs only.

T C M practitioner’s MCs are still not valid for paid sick leave.

Employers are still required to provide reimbursements of medical expenses for paid sick leave from a Government Hospital but not private clinics and hospitals.

Change No. 8 – Budget 2023 Changes In a Nutshell and How it Affects Employers

Change No. 2 – Core Provisions to Extend to ALL Managers and Executives (“M&E”)

a. Higher Tax Deductions On Training

Organisations are already able to claim a 100% tax deduction on training expenditure as a deductible business expense. In Budget 2023, organisations will be able to enjoy further tax deductions of 400% for the first $400,000 on certain courses for YA 2024 to YA2028 in line with SkillsFuture Singapore.

This means that businesses earning decent profits, they would be able to reduce profits affecting tax by considering training expenditure as an expense. Saving money on paying tax means that you would be able to better utiliise this gain for your company. In short, the Government’s message is businesses will benefit if they send their staff for training and upgrade workforce skills.

b. Working With Academic Institutions

To promote innovation, if organisations work with polytechnics, ITE and other qualified partners such as A*Star in certain specific areas of research, engineering, IP-related activities and software development, the Government will introduce a new tax deduction where businesses can claim a 400% tax deduction for up to the sum of $50,000.00 for each year from YA2024 to YA2028.

This means that if you spent $50,000, your organisation would be able to deduct $200,000 in tax deductions from net profits. Less tax payable means more monies for the organisation. The message is that for those who can collaborate with these academic institutions, there could be benefits of innovation, more profits and saving of taxes;

c. Cash Instead Of Cash Benefits

The above schemes are meant to be flexible in that if an organisation does not wish to have tax benefits, you could request for it to be converted to cash of up to $20,000 per year of assessment (YA) with conditions of having at least 3 full-time local employees with salaries of $1,400 and employed for 6 months;

d. Enhancing PWCS For Lower-Wage Employees

To better support lower-wage employees, the Government will be enhancing the Progressive Wage Credit Scheme for those earning up to $2,500 and those earning up to $3,000. To obtain the benefit, the employer must increase the wage of these employees by at least $100 in each qualifying year to be eligible for PWCS.

Employers need to understand that the government co-funds the increase in wage and not the full sum of the employees’ wage for a period of 2 years. Employers should therefore have sufficient budgets for the periods after the PWCS stops;

e. CPF For Platform Workers

If you have platform workers in your workforce, this 2023 Budget will now require employers to align CPF contribution rates with current employees. Those platform workers who choose to opt-in will receive CPF contributions which also affect their take-home income each month. This Budget will provide financial support to allow platform workers to ease into the new scheme;

f. Higher CPF Payments For Seniors

The heavily discussed topic is that seniors above 55 years of age will receive an increase in their CPF contribution rates which will take effect from 1 January 2024.

The obvious impact on employers will be the higher costs for the employer’s portion of the CPF contribution. More importantly, for the 60 to 65 seniors, CPF contributions by employers for employer’s contribution will increase to 26% by 2030.

It is no secret that Singapore will face an aging population and the population living longer. It is to ensure that seniors will have more to save towards retirement but definite increase in business costs to employers.

Recap – key employment policies employers must review

We would add that due to the nature of work, there should be in place confidentiality clauses, non-compete and non-solicitation clauses.

We would add an expectation table so that employees are aware of what to expect of him or her so that employers can assess what is poor performance.

Often, there is no benchmark to determine what is satisfactory performance and poor performance. Also, it includes other factors which could contribute to reacting with other employees.

Having a top performer but actually who has a toxic personality in the office such that it affects other employees and other employees eventually resign because the employer’s work environment is emotionally hostile.

Concluding Comments

In the words of the Finance Minister, Mr. Lawrence Wong which he delivered in Parliament recently said, “in a dynamic and vibrant economy, we must expect a continual refreshing and updating of jobs. Unproductive jobs will become obsolete, and new, better, more productive roles will be created in their place…This churn is an integral part of healthy economic growth but it does create uncertainty for workers. Because workers will need to re-skill and upskill to stay relevant…That is why we are investing significantly in skills and human capital, to help our workers progress in their careers and earn better wages.”.

In the same vein, employers will need to refresh and update their documents and have a system and structure that will support the Government’s role in investing in skills and human capital.

Identity the changes in your Employment Agreement and Employment Handbooks and make the changes immediately to be in line with current practices. Make the Employment Handbook dynamic by constantly reviewing and updating the policies.

Check and update your existing employment agreement so that you are ahead of the curve;

Communicate all changes with your existing employees so that you have consensus and understanding in your organisation;

Create an expectation table for your employees so that they are aware of what is satisfactory performance and poor performance. Benchmarking could ease

If you do not already have a Dispute Resolution Platform for your aggrieved employees, consider a platform for them to be able to raise grouses so that it does not have to be resolved at mediation or ECT but done internally. This helps increase productivity by saving time and energy for managers dealing with unhappy employees and easing any foreseeable tensions that may exist between employees and management.

Have you kept up with the changes!

Let Us Help You

Please enter your details below and we will get back to you in 1-2 working days.